Kicking off B2B SaaS competitor research [with template]

B2B SaaS competitor research is an important step to take to position yourself in the market. Use this template to get started.

Marketing surveys are a small piece of market research, but their impact is enormous.

When a B2B SaaS marketing agency or company is trying to understand the main pain points, fears or dreams of their target market, survey data can provide a road map to success (or at least the right direction) for marketers and the whole company.

.png?width=231&name=Group%20314(1).png)

While face-to-face, in-depth interviews and focus groups yield productive results, it’s dependent on what your goals are for conducting the research and the problem you’re trying to solve.

Here are the general benefits of research when using surveys:

However, surveys also have drawbacks.

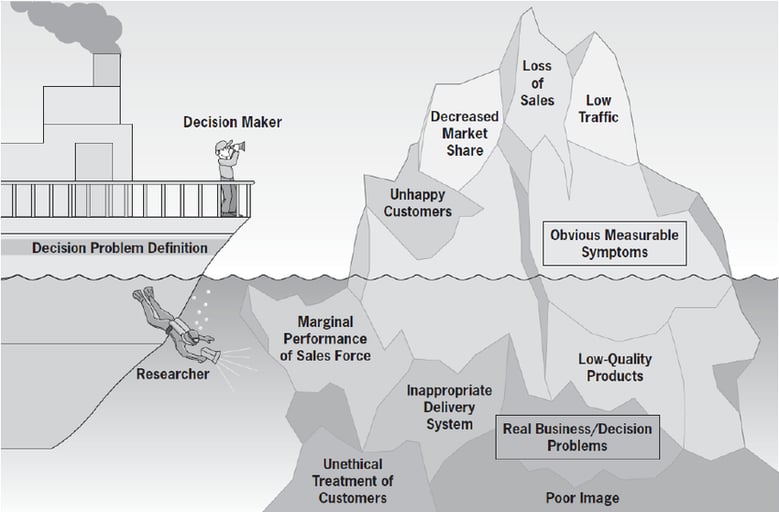

Your research problems can be anything - How to improve customer experience, assess the brand associations, demand for a hypothetical product, buying patterns, self-image, internal drives, anything...but make sure you’re specific.

If you’re trying to understand the traits and qualities consumers think of with you and your competitors, your RQ might be “What associations do consumers have with primary competitors?”

Losing focus on the problem at hand leads to overspending on resources, poorly structured survey questions, the wrong sample size or population, or even ending the process empty-handed without the actionable results you were looking for.

When setting your research problem, follow these steps:

When you follow these 3 steps you get a clearer overview of the problem’s larger environment at hand -- and just how complex it is. If you’re feeling overwhelmed, it’s ok! By the end of this process, you’ll be surefooted and confident in your ability to conduct marketing research and get the answers you need to solve your problems.

Always begin with secondary research to establish a solid understanding of what's been researched and what hasn't in your field. Secondary research could be anything on your topic or problem from market statistics, trend reports, competitor research and even sales data.

If your research question has already been answered by others and they’ve shared the data somewhere, you’ll be saving a lot of time, money and resources. If you don’t do your secondary research before conducting marketing research, you’ll come to kick yourself down the road.

Many B2C companies use market research and consumer data from Nielsen and Kantar, however those firms typically provide more value for B2C companies looking for demographic, psychographic and other segmentation insights into their consumer base.

There are multiple types of marketing research -- exploratory, descriptive and causal -- and lead to different survey formats. Oftentimes, market research is used to answer the following questions:

Let’s break these down even more:

This can help companies identify new options or action plans you’ve never considered before and is best for exploring new product ideas, listening to customer preferences and identifying areas of growth.

For many B2B SaaS companies, exploratory market research provides insights into problems many of your customers (or potential customers face) and provide you with new ideas, solutions or tools to develop.

If you’re attempting to understand the size or complexity of a marketing variable you identified in step 1, use descriptive research to identify how much it’s impacting your company, where new areas of opportunity are for your market or business and how to understand the needs of your target customers.

For B2B SaaS companies, descriptive market research can test the presence of external relationships between your market’s satisfaction level and product features, or internal relationships like employee income and job performance. It’s important to understand that this kind of research tests the presence of a relationship, not the relationship itself.

When you’re trying to understand the relationship between different variables, you can conduct causal market research in 2 different ways: experimental and statistical. For most of you, statistical research is where you’ll focus your time on.

Determining the cause-and-effect relationship between your research problem and the variable(s) it’s impacted by are the next step into solving your problem. Causal market research in B2B SaaS companies can test the relationship between price and product, the impact of certain variables on the buyer’s decision-making process or even negative experiences that led your respondent to another solution.

All of these marketing types provide insight into how to improve, grow and beat competitors.

Depending on what you’re trying to figure out, your survey will look very different. There’s a big difference between testing favorability toward different logos and uncovering subconscious buying patterns that influence a customer.

To create your survey, follow these steps:

If you don’t currently have a survey platform, consider the user-friendliness, scalability and data-processing needs you have. If you’re going to be dealing with large sample sizes, you need a survey platform that can handle and store such a large amount of data.

Depending on if you’re going to manipulate data outside of your survey platform (with SPSS or another data analytics program) or within the software, identify the competency of potential survey platforms.

You can read reviews for survey administration software on websites like Gartner and Capterra to hear directly from customers.

Best practices for creating survey questions are using plain language, writing unbiased and straightforward questions and carefully planning the question formats you provide based on what you’re asking and trying to understand.

If you’ve never designed survey questions before, research what question types are best for your data. When asking questions about preference or satisfaction levels, use a sliding scale with an odd number of choices (scale of 1-5).

It’s also a good idea to chunk parts of your survey based on goal function -- include a section of screening questions to assess who your surveyor is, then follow up with the main section of questions. Finally, make sure you conclude the survey clearly that gives your respondents closure.

Break your market research questions up into different categories. Below are examples of market research questions you may include in your B2B research survey:

After you’ve edited your survey, conduct a little user testing and send it out to some of your coworkers for feedback. It’s hard to edit your own work, so try to get as many other eyes on your survey as possible before you finalize it and hit “Send.”

Send this to your coworkers in slack or email and just ask for feedback or thoughts on a google doc or spreadsheet. Some survey platforms let you generate test responses, so you can look at the fake data and change questions as needed. Rinse and repeat until your survey is as perfect as it can be.

Depending on your platform, you can send the survey to your target market or contacts through your survey platform, your CRM or share the URL to your survey on different social channels.

If you’re sharing your survey with an email campaign, try setting up an email sequence with 3-4 touchpoints. Not everyone will fill out the survey, but a few nudges won’t hurt anyone. And, if the recipients really want, they can unsubscribe at any time.

When you’re drafting the emails, make sure your emails are straightforward and clear about your intentions. If you’re asking someone for time, make sure you’re offering something in return -- whether it’s a discount code, a mention in the acknowledgments or a whitepaper with your analysis when it’s all said and done.

If you were expecting more participation, don’t get too down -- there are plenty of ways to get buy-in from your survey recipients.

When trying to generate responses, send the email or survey link with a few different messages, subject lines of “asks,” and make sure that you’re offering something in exchange for their precious time and focus. Make sure you’re using A/B testing to identify the more successful strategies, and eliminate the messaging that isn’t performing.

David Ogilvy, Father of Advertising, once said "When you have written your headline, you have spent eighty cents out of your dollar." When you're writing emails, think of your subject line as the "Headline" -- it's got to be good.

Pro Tip: You can test out different headlines with subjectline.com and see what's considered a "good" headline. Try to aim for a score between 80-100.

It’s also worth noting that in some industries, the more personalized and simple, the better. Some of the most successful email campaigns are simply 1-2 sentences asking for participation in the survey for research, and ending with a survey link. It doesn’t have to be rocket science, but know your audience and try a few different methods out to optimize survey responses.

This incentive can come in many different forms -- submitting someone for an amazon raffle, giving everyone a $5 Starbucks gift card, providing a product or service discount, or even a backlink on their website. Or, you can create more tangible industry knowledge with your survey responses like industry whitepapers, an analysis of findings, a webinar series or an infographic that represents the data you’ve collected.

If you’re still not getting any responses after trying different messaging strategies, consider shortening your survey, changing the answer format of your questions or even picking a different list of contacts you’re sending to. Make sure this audience understands the added value you’ll return with their support, and emphasize your appreciation for their time.

Your data is powerful - but also powerless without the right analysis. Whether you use machine learning, hand this off to your IT department or hire a third-party data analytics firm. Remember that everything you’re doing is to answer the initial research question -- stay focused on pulling data that support an answer.

Export the data into SPSS or conduct analysis within the platform. When you’re analyzing the data, try not to feel overwhelmed -- just take it one step at a time! Above anything, remember the question you’re trying to solve, the driver of your research and the problem you need to overcome.

There are different ways to make sense of survey results, and they range from simple to complex. From frequency to cross-tab analysis, analyzing your data might take a long time (longer than you expected).

Now that you’ve completed steps 1-5, the only thing left to do is communicate and translate your findings into actionable items. Sum up your processes for building, administering and analyzing the results, and summarize with key findings and limitations.

When presenting data like this, consider using data visualization tools to explain your findings and then clearly connect the significance back to your original research problem. This could be anything from using a pie chart or bar charts to display quantitative findings, or a word cloud to showcase your open-ended qualitative questions!

It’s also a research best practice to note any shortcomings of your research, unexpected results or data you haven’t made sense of.

By identifying areas of weakness and potential growth, you’re both validating the legitimacy of findings by giving your audience a well-rounded picture of your process and reminding your audience that while it’s impossible to conduct a 100% perfect survey, you’re trying your very best to find meaningful and truthful data.

Above all, though, your research findings should provide 3-5 actionable insights for your company based on the initial research problem. These action items are the driving factor behind your survey research, and make the future roadmap of your company and strategy data-backed to optimize your inputs for outputs.

.png?width=231&name=Group%20314(1).png)

Once you've done the hard work of building your market research survey, getting participants and analyzing your survey results, make sure that doesn't go to waste.

Even if your initial research question wasn't backed by participant data, it's not a waste. Analyze and save this information for future product development, customer success, sales and marketing initiatives.

To learn more about market research and surveys, check out these blogs:

A content marketing specialist at Kalungi, Liz enjoys writing and learning about anything and everything. Since obtaining her BA in English and her BS in Marketing at NC State, she's carved a path educating, engaging and exciting B2B SaaS markets through powerful content and messaging.

B2B SaaS competitor research is an important step to take to position yourself in the market. Use this template to get started.

Writing about a topic you aren’t familiar with seems daunting. With the right tools to organize your b2b content marketing research, it’s a breeze.

B2B SaaS SEO content is a cornerstone of marketing. Let's learn how to conduct keyword research and create SEO-friendly content for your B2B SaaS...

Be the first to know about new B2B SaaS Marketing insights to build or refine your marketing function with the tools and knowledge of today’s industry.