Understanding T2D3: The Cheats to a Sustainable Growth Formula

Learn best practices to properly apply the T2D3 formula to your B2B SaaS growth strategy and attain a sustainable growth formula and pricing model.

How will you achieve T2D3 growth? Learn the 5 factors to build a B2B SaaS growth strategy after achieving product-market fit.

Get monthly GTM frameworks in your inbox.

T2D3 is about driving exponential growth after achieving Product-market-fit. This crucial phase of a go-to-market strategy requires you to move from single-threaded tactical execution to a multi-threaded strategy that drives growth along multiple SaaS growth dimensions.

In this article, I will discuss each of these 5 growth levers, and how to execute them in the right order. Your team needs to learn how to drive all these growth tactics in parallel.

Before I dive in, let’s recap why the T2D3 formula is so important? A SaaS business is like a big flywheel of growth that can be unstoppable once it gets traction. This flywheel also takes a lot of energy to get going, to gain that initial momentum. After your company hits product-market fit, a critical period follows to get to that T2D3 exponential growth pace fast. The T2D3 acronym, triple-triple-double-double-double, describes a five-year period with a 35% compound annual growth rate every year. If you can achieve this, you will get to the coveted goal of 100 million ARR.

Here’s a B2B SaaS marketing plan template and playbook for software companies.

SaaS economics are based on customers staying with you for a long time, paying you more over time, and they ideally say that they like your product to others. This drives more customers to try your solution and increases the customer lifetime value of those SaaS customers. This makes SaaS such an attractive business model and allows for significant upfront investments to “get the flywheel going.”

So, what is T2D3 growth in B2B SaaS, and how to achieve it? Below is a picture that you may have seen before. If you Google T2D3, this is typically what you find. T2D3 stands for triple, triple, double, double, double. It was introduced by SaaS investor, Neeraj Agrawal, in 2015. In brief, it describes a trajectory of two years of tripling your annualized revenue growth, your ARR, and then three more years doubling that.

.png?width=5451&name=T2D3%20Path%20to%20$100M%20(page%2010).png)

The T2D3 revenue growth curve is a common expectation by investors when they provide growth capital for companies who have reached product-market fit (and usually a couple of million in ARR). T2D3 describes the growth path needed to go from PMF to 100 million ARR in about five years (and earn that coveted $1 billion unicorn valuation). Let's dissect the 5 steps in the journey, starting with about 2 million ARR after reaching product-market fit.

The first year is about tripling to 6 million ARR. You need to start doing real marketing and sales (or product-led growth if you have a relatively low ACV/ARPU, more on that later in this article).

Implement focused marketing and sales using your newfound understanding of your ideal customer profile (ICP). You discovered your ICP by getting to product-market fit, and now you can build upon this first beachhead and optimize your positioning. These efforts will impact MQL volume, the cost of demand generation, and conversion rates of leads to wins.

KPI Focus: MQLs, Conversions and CAC

In the second year, you triple one more time. Start by consolidating your revenue base reducing customer churn, so that your new revenue builds on top of an ever-growing, recurring, revenue stream. Most companies start getting substantial new business from referrals as well in this second year of the T2D3 journey.

KPI Focus: Churn, MQLs, Conversions and CAC

In the third year your growth starts to slow down, and you “only” must double ARR now. Your sales team needs to increase the average contract value, or ACV, per new customer win. The ability to sell higher-priced solutions, and limit the amount of discounting, is key to driving what’s called ARPU expansion.

You are probably starting to do some upsell and cross-sell. In addition to selling bigger deals, consider splitting sales efforts into new business sales and account management. The latter will focus on revenue upsell of existing accounts, and sometimes is organized as part of your customer success team.

Your marketing team keeps finding more ways now to drive demand gen from multiple channels, like industry-specific pay-to-play options, analyst relationships, creative partnerships, and product-led growth plays.

KPI Focus: Churn, MQLs, Conversions, CAC and ARPU

Year four is the make-or-break year for many successful B2B SaaS ventures. Your category is maturing, and you are in for a fight with the few remaining competitors for dominance of the market you are in.

The growth drivers needed to get you into the next gear of growth include reducing funnel friction, a laser focus on optimizing conversion rates, and driving down customer acquisition costs. Reducing CAC is key as the cost to keep playing in a mature category will go up as you compete for every click and search position. You need to optimize your marketing-sales handoff and secure a #1 position in at least a couple of subsegment “niches” in your market.

An important part of driving growth in this fourth year is to up-level your team with A-level talent. While you might not have been able to afford the top players before, now you are (and so are your competitors), and to stay on top and double ARR again, upgrading your team is key. You're now also starting to get attention from analysts, or from influencers who call you a market leader or challenger.

Finally, year four can be the right time to consider adding a channel strategy to complement your go-to-market. I don't recommend doing this earlier, as you need size to matter to your business partners. It’s hard to recruit resellers or find development partners when you're not considered one of the category leaders or challengers. While you can do channel development and have a channel program, if you're too small, they're just not going to prioritize you versus some of the other vendors in the market. Now in year four, you’re right at that point where you can afford to invest in a channel model and can get the attention and loyalty from new partners to make it worth it.

KPI Focus: Churn, MQLs, Conversions, CAC, ARPU, Partners and your People

The final year of the T2D3 growth curve means you need to double one final time. If you have attained dominance in (parts of) the market you’ve focused on thus far, consider expanding your Ideal Customer Profile and cast your net a bit wider. Should you go global, up-or-down market, or enter adjacent industries? Should you expand your solution portfolio and sell more to your existing type of clients? Can you “buy” more ARR through M&A activity? Learn more on expanding your GTM.

To unlock that potential $1 billion unicorn valuation, you need to move your focus from T2D3 exponential revenue growth to driving profitable growth. The common term that investors use is the Rule of 40. The rule basically states that by combining your compound annual growth rate and your profitability, you should get 40 percent. As revenue growth slows down, say to 30 percent, you must then compensate for that by making at least 10 percent profit, adding up to 40 percent. You achieve this by changing your focus from reducing Customer Acquisition Cost (CAC), to optimizing Cost-to-Service (CTS).

The very steep curve that you saw in the previous illustration is well documented in a McKinsey study from 2014, called “Grow Fast or Die Slow”. Even while the data is a bit older, the study effectively describes the small probability that faces B2B SaaS companies to make it through the five T2D3 growth gates. Here are a couple of quotes from that study that I think are worth sharing:

"Unlike many other industries, if a software company grows at only 20 percent per year, it has a 92 percent chance of ceasing to exist in a few years."

Why is it so hard? 20% seems like a healthy growth rate, right? The reason is, that in SaaS, and especially in B2B SaaS, there is a winner-takes-all dynamic. So, unless you hit that relatively steep growth curve, and are part of the small group of category winners, you can quickly become irrelevant (unless you find a way to carve out a new niche, in which case your 5-year clock after PMF gets a reset).

“Even if a software company is growing at 60 percent annually, its chances of becoming a multibillion-dollar giant are no better than 50/50.”

While 60% is a very high growth rate, unless you achieve this outcome a couple of years in sequence, and hit the right SaaS value drivers, it's hard to become a unicorn with a billion-dollar valuation.

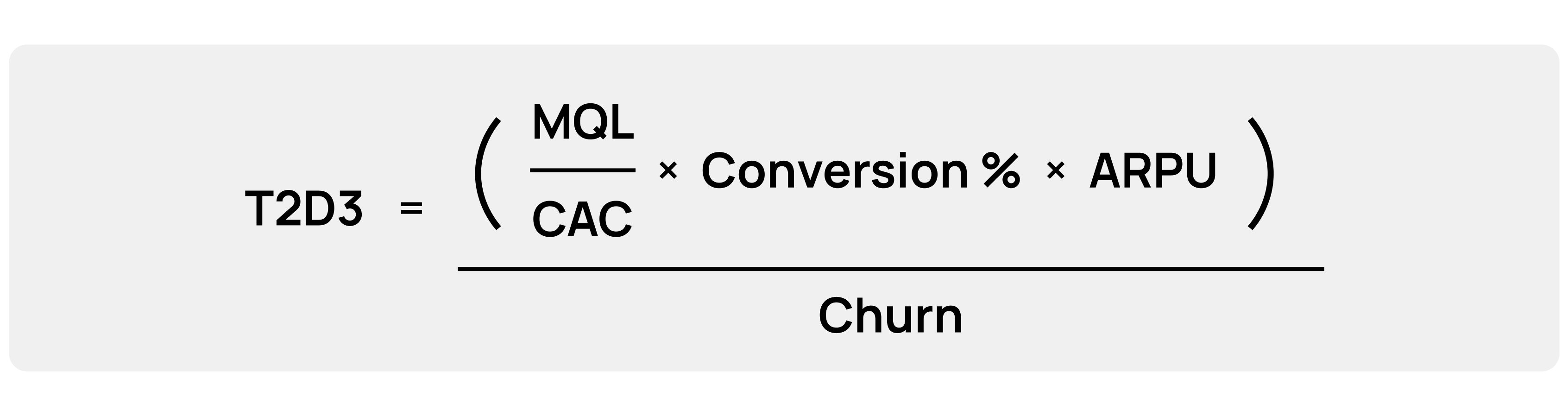

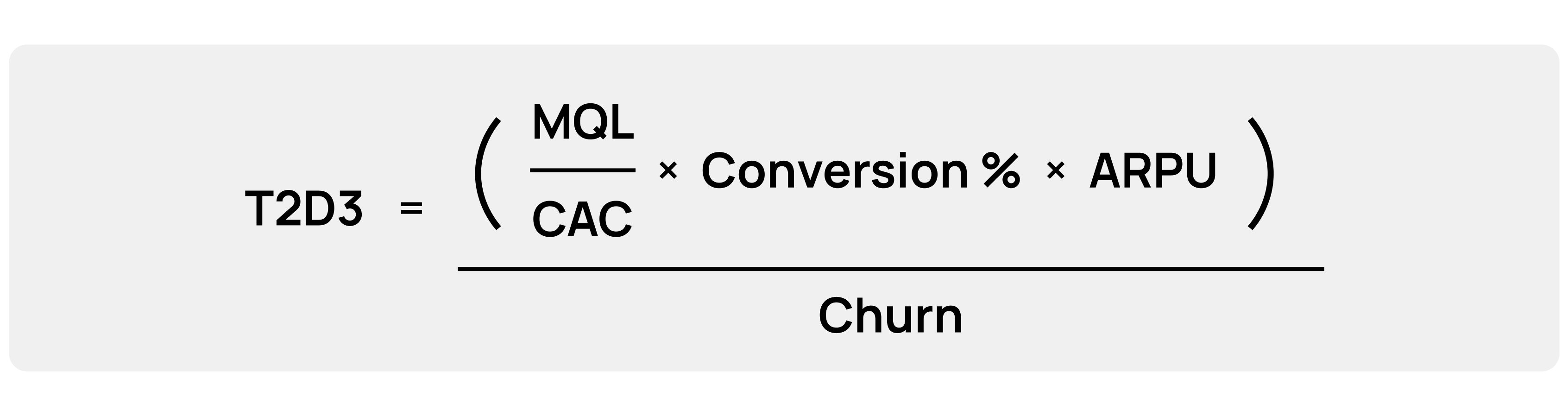

As you can see in the above, to drive T2D3 growth you need to manage multiple growth levers at the same time. That's the essence of T2D3 success. It is very difficult, and a big change after the laser focus on only a few priorities that got you to Product-Market Fit. So, let's look at the formula to summarize what you need to do to hit this growth rate.

This is not a mathematically correct formula. Consider this an instrument to make sure, as a growth leader, you're thinking about all the different things you need to do to drive that exponential growth. Let's walk through this left to right.

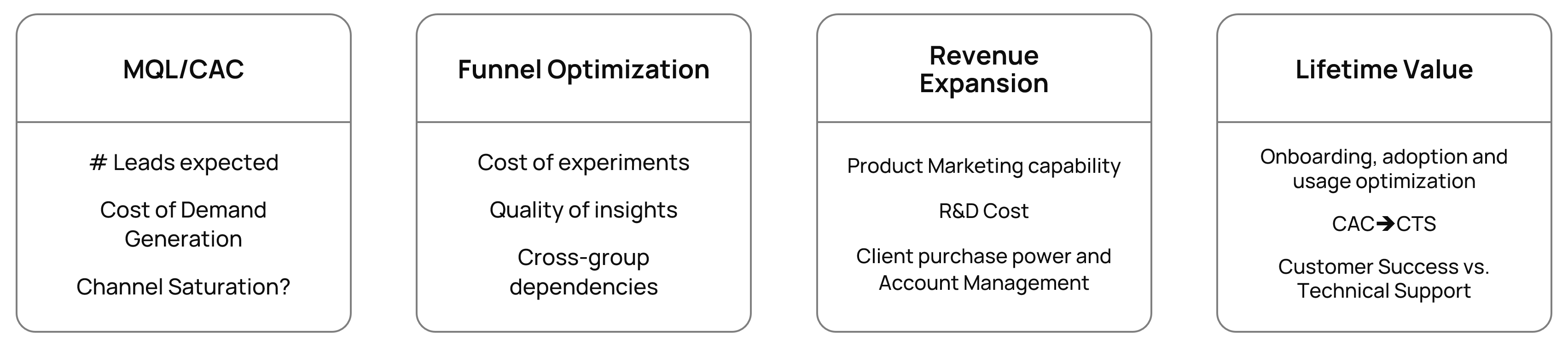

T2D3 growth factors

T2D3 growth factorsThe formula is a simplified overview of the following factors that together drive exponential recurring revenue growth:

Let’s now dissect each of these further.

There are basically five different factors that go into the T2D3 growth formula.

The first factor is to drive demand generation from multiple sources. I call this demand generation diversification. That's what the MQL (Marketing Qualified Leads) part in the formula stands for. Consider this a general proxy for the size of the top off the funnel, including all types of leads and brand awareness.

You need to expand your demand generation to multiple channels, for example organic, paid, social, sponsorships, account-based marketing, and new partnerships or markets that you can enter. After one of these demand generation channels has helped you get to product-market fit, to hit T2D3 growth, you now need to have multiple demand generation sources that all help drive up your MQL number.

As you expand your demand generation channels, you need to drive this demand at the right cost. You need to optimize the customer acquisition cost. That's the CAC factor under MQL in the T2D3 formula. Especially when you hit the 3rd and 4th year of T2D3, from $18M-$72M ARR, the market you are in is usually becoming more mature and costlier to compete in. You have to pay more for clicks; organic search positions get more competitive, and people will be harder to recruit and retain. Thus, a laser focus on keeping our CAC under control becomes critical.

After you increase lead volume from multiple channels and lower the cost per lead, those leads need to convert into customers. You need to optimize conversion rates at all stages of the funnel. This includes the actual marketing conversion (i.e., landing page conversion, ad-click conversions, email open rates), and the smooth handoff of leads to sales. The ability of your SDR or BDR teams to follow up fast, and convert leads into prospects and qualified opportunities for your Account Executives is very important.

You need to approach conversion optimization holistically. This is not only digital a/b testing and running analytics and experiments, but also creating the right materials for your sales team, having enough customer references, the right demos and objection handling playbooks, an ability to convert trials into buys, and making sure won contracts end up as payments that hit your bank account.

The fourth T2D3 growth factor is driving more revenue from each user, customer, or any other denominator of your pricing model.

ARPU expansion is a combination of:

This factor is driven by a combination of product marketing, training the sales team, and cross-selling with your account management or customer success team.

The combined factors above the line in the T2D3 formula drive Annual Recurring Revenue (ARR). Top-line ARR grows by increasing the number of leads at the right cost and converting those at the right pace, into deals that get bigger and bigger and bigger.

Under the line, the final factor almost trumps all the others. Churn. If you get new customers at the right price, and they buy a lot from you and keep buying more, none of that matters if you lose those customers. So, churn and customer retention are critical for achieving T2D3 growth as a SaaS business.

To drive down churn, consider:

As a growth leader, to drive T2D3 growth for a company you need to look at all these different factors, and basically have a plan for all.

Your team will be challenged as you come out of product-market fit. Untill now, you focused on doing a couple of things well, and now you have to drive multiple growth tactics at the same time. You need a go-to-market leader who can execute product marketing, demand generation, influencer management, PR, sales support, channel management and many other marketing initiatives at the same time.

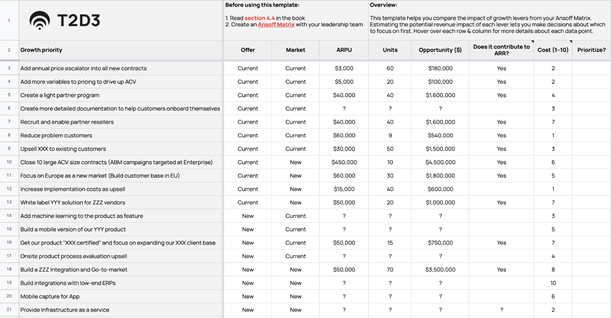

As part of the T2D3 Masterclasses and Pro-member subscription, you can learn to use, and download, an easy template that helps you plan all your tactics and calculate the impact on T2D3 growth using the five factors.

As you embark on the path to exponential B2B SaaS growth, you first need to assess where you are and account for the maturity of your market category. Combining both the maturity of your solution vs. product-market-fit and the state of the market segment will inform the best go-to-market strategy for exponential growth.

Now that we’ve dissected the various components that go into driving T2D3 growth, let’s discuss what your starting point is. Understanding your jump-off point will make planning the journey easier. I call this situational awareness.

There are really three factors to this situational awareness.

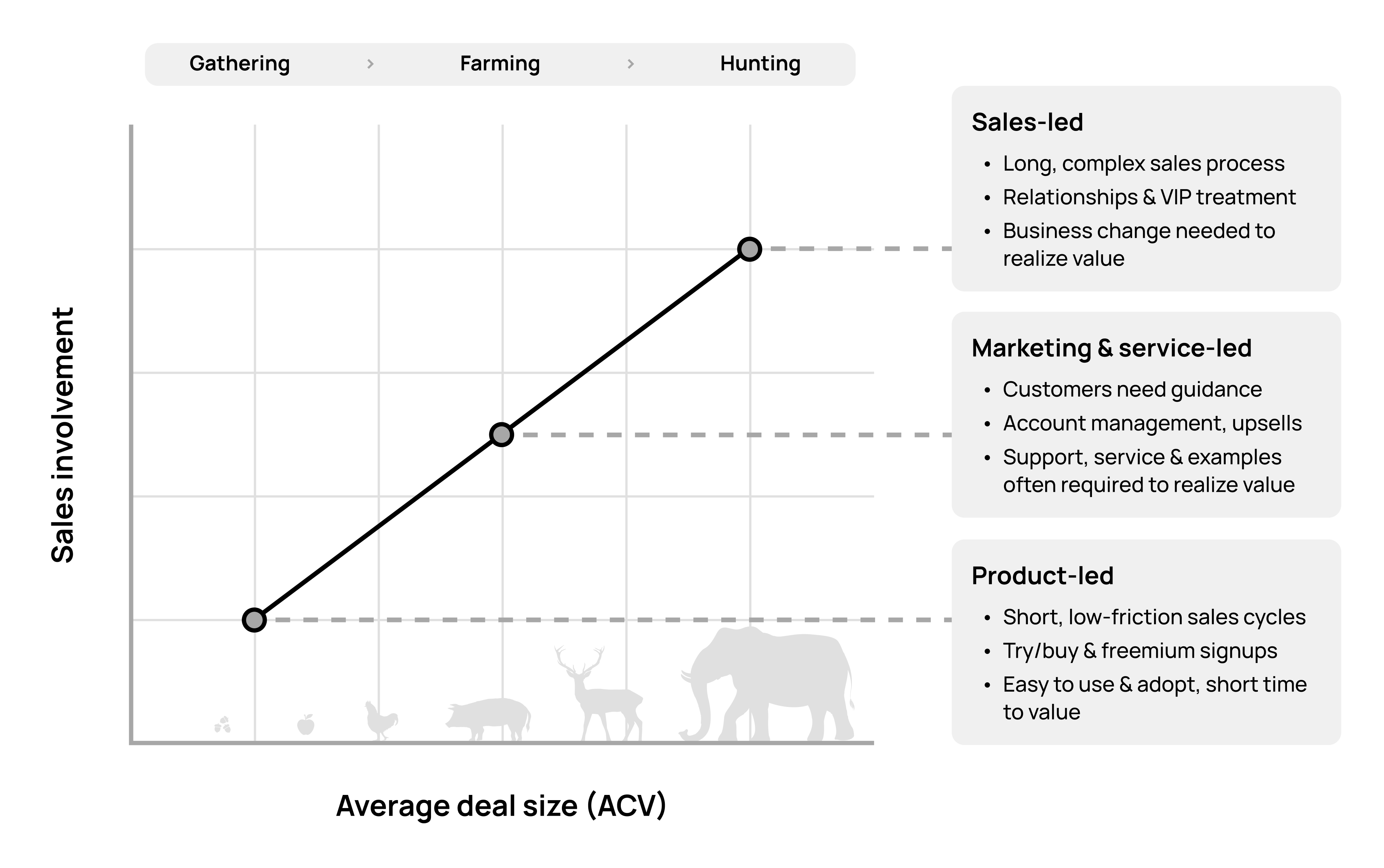

This starts with making some assumptions about your expected ACV, or Average Contract Value. This is a proxy for the amount of money that a customer will pay, typically in the first year. You can replace this with LTV, lifetime value. Either LTV or ACV will help you determine what you can afford to pay for a new customer, and thus the type of go-to-market your growth journey will be able to sustain.

I prefer using ACV over LTV, especially in an earlier stage of the T2D3 journey. In my experience, most churn assumptions that drive LTV are not really proven at this stage of growth. Most companies have limited historic data and making it hard to predict what the lifetime value will be. This leads to LTV often being overestimated, so to be safe, I prefer to use ACV.

The ACV dimension can be simplified to three ways to build a business that scales to $100M ARR. Each of these will afford you a certain type of go-to-market. Product-led growth can support the low ACV tier, Marketing-led growth is for the middle tier, and Sales-led growth is the most common for the top tier ACV.

With an ACV that is at least $1,000, you can only afford a low-cost go-to-market approach. This usually means you must do what's called product-led growth. You need to get relatively high numbers of users or customers. If you have $1,000 in ACV from one client, you need 100,000 customers to get to 100 million in ARR.

Product-led growth at its core is about a very low friction growth engine, where you don't have to keep investing in marketing and sales to get more customers. The product and how people use it, do most of the"growth" heavy lifting. Things like customer referrals, and making it easy for people as they use the product to use more, are your foundation of growth. You basically drive customer acquisition through the product usage dynamics, complemented with some other things that will help here (Influencer marketing might be a great way to scale as well). While it’s not just the product, that's where most of the growth in this go-to-market strategy will come from. This model is the only way to sustain a relatively low ACV for a longer period and have a successful, profitable company.

In the next segment, the middle tier, are Customers that yield about a $10,000 ACV for the first year. You’ll need 10,000 of these to get to $100M.

With this ACV you can afford to use traditional marketing to drive growth. You can afford to buy, for example, pay-per-click advertising. You can afford to invest structurally in content marketing, to educate customers, and to help them make decisions as they go through the funnel. You’ll need to build all kinds of lead magnets and have sophisticated, automated nurturing.

You can consider account-based marketing if you can do it at a relatively low cost, by being very targeted in how you get audiences to know about you and help them understand why you are the right option for them. You can use ABM to convert them into customers through scalable automation mechanisms that are typically marketing-driven.

I added “services-led” in the Marketing Led Growth strategy, to account for ways to drive growth from customer success or paid professional services. If you don't need to hire dedicated salespeople, but you're using scalable forms of marketing and services to help drive customer acquisition, that can still fit this middle tier.

The top tier would be $100,000 in ACV, where you only need 1000 customers to achieve your ultimate T2D3 growth goal. Now you can afford to have salespeople. Dedicated salespeople are costly but might be worth it at this ACV level. If your ACV is high, it can be good to add friction to your funnel. Good sales executives can turn relationships and friction into higher values per customer, higher ARPU, higher ACV.

You may have heard the sentence, "Mystery is margin." For a sales-led growth model, I believe you have a good reason not to talk about price on your website. You want to make a lot of these things harder to understand so that your prospects must talk with sales, and they can make sure that every customer gets exposed to all the bells and whistles they might need.

So, it's important for you to know where you are on this ACV spectrum. This will help you understand what type of go-to-market models you can entertain. This is the ACV part of situational awareness. The other situational awareness is about where you are as a company, and how mature your category is.

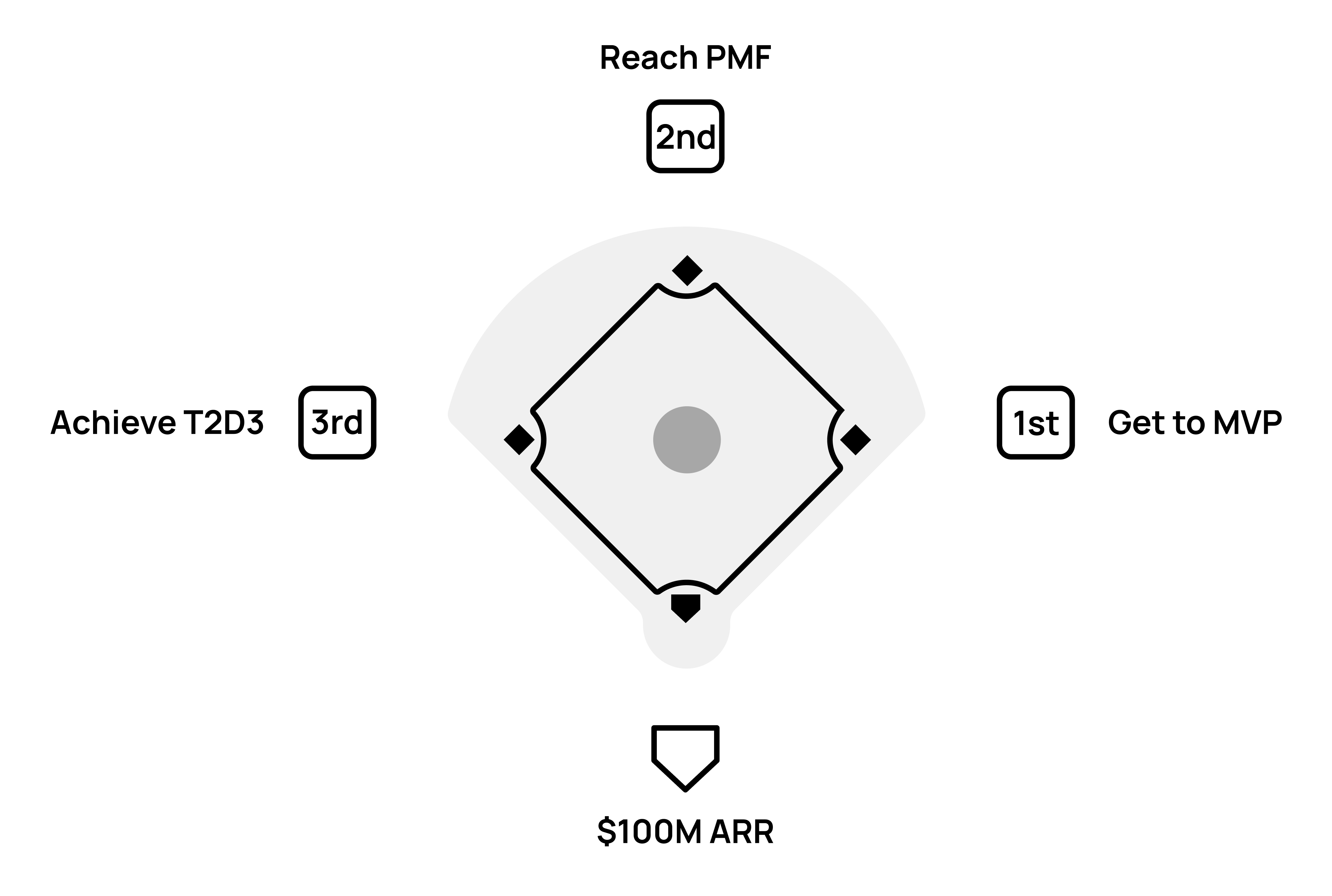

The below graph shows the company maturity journey. I like to think of it as four steps. This is a baseball diamond, making the point that you cannot really skip second base... You cannot get from first base to third base without going to second.

Getting to MVP is all about getting your first customers. You need users who really vote with either their time or with their wallets, and say, "This product, this solution is valuable. And I don't want you to take it away."

Some of the MVP indicators are customers who are helping you build the product. They help you complete it. They help you promote it. These are important milestones to hit early in the journey, to get to what's called a Minimum Viable Product.

The second base is to get to product-market fit. Now you need enough customers that pay and say, "This is how much I value your solution. This is how important this solution is to me. I recognize that I have a need. I have a problem. I have a pain point. And I'm willing to pay for that."

You also need customers who not only pay but stay with you. This is where you are starting to look at churn. If you get a lot of customers, but they all leave, you haven't reached product-market fit. So, you need customers who pay and stay. And then ideally, they also say so to others to start driving referrals.

At 2nd base, Product-Market Fit, you now have found a beachhead where your solution meets a problem in a powerful way. Your customers are not only paying you, and staying, but are going to tell others about your solution. Because they think it's valuable for others as well. You're trying to strike the right balance between attracting early adopters, people who are willing to take some risk, who like your solution, and who don't necessarily need thousands of other people who've gone before them. But you also need to make sure that those customers really reflect the value that they see in your solution by paying for it.

Once you've hit product-market fit, you're ready to achieve T2D3 exponential growth. That's third base. Now you need to scale your growth using the formula that we discussed earlier in this article. You must drive customer retention- and referrals, achieve ARPU expansion. Diversifying your demand. Optimizing conversion. All those things happen in that third base, T2D3 growth leg of the journey.

Finally. Home plate. Once you hit the 100 million ARR, you should start to focus on profitability. Driving the Rule of 40, combining continued growth with profitable growth. You change your focus from customer acquisition cost (CAC), to what's called cost to service (CTS). If you have grown very fast in T2D3, but some of that growth came from customers who may not be easy to service, then the cost to service has gone up. You've maybe added a lot of customer success resources, people, to the team to drive down churn. That might not be sustainable if you now must hit profitability and the Rule of 40. So, you need to shift your focus from customer acquisition cost to optimization of cost to service.

Below are a couple more numbers. This is a rule of thumb sheet, that the team at Kalungi uses to service its customers (Kalungi is the only agency where you can buy Growth-as-a-Service along with the T2D3 model). This is just a cheat sheet to have a conversation with others, with yourself, about where you are on the journey.

These are not exact bands. Maybe one row fits, and the other doesn't. As I mentioned in the opening about the T2D3 curve, you start your T2D3 journey with at least 1 million ARR. You need that and have achieved product-market fit. These revenue bands are indicators where I have usually found companies to be, given the type of growth strategy they needed.

.png?width=4901&name=Maturity%20Stages%20Chart%20(page%2022).png)

The top row in the above table is data from the earlier mentioned study, “Grow Fast or Die Slow, from McKinsey. The data shows how many companies achieve certain stages in this journey. This is a percentage out of 100. So, 26% out of 100, get to MVP. 20% out of 100 get to product-market fit.

Finally, let's determine where you are on the journey to, and beyond product-market fit. I like to use two dimensions, user momentum, and customer momentum, that you can both use to determine where you are.

MVP: Problem & solution confirmed

PMF: Market Beachhead established

T2D3: Expanding from your beachhead

$100M ARR: Driving profitable, sustainable growth

If you want an even easier assessment to see if have achieved Product-Market Fit, here is a simpler list. I made this about 10 years ago…

These 10 steps, milestones basically, help determine where you are on the journey to product-market fit. This is the most important question to understand if you are ready to double down for T2D3 growth. After you reach PMF you know where you can pour more gasoline on your growth fire.

Congratulations if you have achieved Product-Market Fit. You have now created a beachhead that allows you to build upon, and pour more resources into it. When I talk with CEOs, founders, and investors, about the stages that their companies are in, understanding if product-market fit has been achieved, is the most important thing to get clarity on. You only get one shot at doubling down and going for T2D3 Growth with the growth capital at your disposal. You may also be interested in reading about why companies often get stuck after getting to PMF and fail to achieve T2D3 growth.

Visit the T2D3 framework resources, to find many more templates and articles to help you build and execute your B2B SaaS Marketing Growth strategy to drive exponential growth.

Learn best practices to properly apply the T2D3 formula to your B2B SaaS growth strategy and attain a sustainable growth formula and pricing model.

Find a T2D3 WOD Exercise to make constant improvements driving GTM growth, efficiency, and effectiveness. Learn how to use Workout of the Day to...

Three areas you can focus on to patch the leaks in your funnel, reduce churn and keep customers to reach T2D3 growth.