Using a Feature Matrix for B2B SaaS Pricing Strategy

Learn how completing a B2B SaaS pricing strategy and feature matrix can help determine the right pricing for your products and services.

Learn B2B SaaS pricing models and strategies to address rising costs and inflation in today’s economy.

Get monthly GTM frameworks in your inbox.

I get so many questions surrounding SaaS pricing strategy - particularly with the tremendous rise in costs and wage inflation over the past 12 months. If companies don’t pass the costs along to their customers, it’s a direct hit to the EBITDA margin and, ultimately, to the value of the business. However, there are differences in business models that impact the ability to pass along price increases.

In general, SaaS is a model where the ability to respond to inflation is desirable because customers can't use the product without paying for it. If you have the ability, contractually, to raise prices, that's a good start. In other cases, it's more complicated. People are wrestling with what kinds of price elasticities to expect, the net impact of raising prices, and the models to use.

Customers are to some degree inured to the fact that everything in their basket will go up - costs will increase. As a business owner, you determine whether you can afford to be the one that doesn't raise their prices when everyone else is. The answer is probably not.

As your business grows, you're trying to add value. You’ve been adding to and improving your offerings. You think your price has to reflect some of that added value, so it should increase, but you’re not sure when. In this high inflationary environment, suddenly everyone is thinking, "Okay, now I should” and “I don't want to fall behind."

The interesting thing is that's actually a flaw in strategy to begin with - because it means you're thinking of cost-based pricing. Your ambition should be to get away from cost-based pricing and think about not only how do you compare to the rest of your competition and the market, which would be market-based pricing, but how you get your pricing to be aligned with how you're creating value.

The value of your solution is not only created by having more features or capabilities; it's also based on credibility - when you're in the markets longer, your credibility goes up, you have more customers, you may have more coverage, you have more people that are supporting your customers. All those things in the end add value.

While raising a price is a relatively straightforward, strategic choice, it's not easy to implement. There are a lot of considerations that go into it. Firstly, why should you do it? To answer that, we need to review how to grow a SaaS business, specifically when using price as a growth lever.

The above principles apply to a lot of business models these days. Price is probably impacting most of these bullets, specifically the five in bold.

Service is the new sales for a lot of businesses and a lot of markets. It's about how do you retain your customers, and how do you get more out of them? Monetizing is about getting more compensation from your existing customers, either because they use more or because they tell other people about your product. You upsell- and cross-sell new capabilities, and then they pay for that, leading to ARPU expansion (where “A” can stand for average or annual, I've seen both). Revenue per unit could be per user or per device, whatever your pricing model is based on.

Retention is often a function of value, but some of it also has to do with price (and of friction when people aren’t aware they're actually on an auto-renewal plan). You want to reduce churn and ask if people can afford your product. Are your current customers willing to pay more? If you raise your price too much, does that trigger someone on auto-renewal mode to cancel? Perhaps they were not even using your service, it was not on their radar, but because you raised the price, it suddenly becomes top of mind, and then you risk impacting retention negatively. Thankfully, you can do things with the price that positively impact retention, and we'll discuss that further.

Finally, winning new business is, of course, part of every growth plan. But in reality, when checking off these boxes, the left one should be bigger than the middle one. And the middle one should be bigger than the one on the right. If you think of how these three ways of growing a business typically impact in the case of SaaS ARR and recurring revenue, winning new clients is a smaller part of growth than retaining them and retaining is a smaller part of growth than actually getting more revenue from your existing customers.

There are tools, surveys, and methodologies (such as the Van Westendorp Price Sensitivity Survey and the Gabor-Granger Pricing Method) that test the elasticity and absorption rate of customers or markets. But in the end, it's not very scientific. One thing to look at is often referred to as The Latte Index, which compares currency and purchasing power by the price of a Starbucks around the world. This data is from 2019, but it puts you in the shoes of people from Turkey to Denmark.

It shows the extremes - some undervalued and some way overvalued - and the average. It's interesting and tough to rationalize how much higher each of these is than the other. It may be driven by, for example, the ability of people to afford something. Is there some kind of market-based pricing at work in addition to just the perceived value? And even when you add that, what makes it affordable? It’s about incorporating other things, like taxes and the cost of living.

So it gets pretty tricky. It’s very hard to answer the question, “what is the right price?” It's hard for your customers to answer the question, “what should I pay for your service, for your product?” Whether you're recycling tires, selling a software product, or providing some kind of high-end medical procedure. Pricing may change based on: location, alternatives, comparables, speed of deliverables, and customer reviews.

All that to say, it is extremely hard to have any scientific rational reasoning behind what your price should be. There are so many variables that if any of these becomes a reason not to raise prices, I would challenge it.

The reasons you should raise prices are tied firstly to growth in value. In the value that you're adding to the market, whether it's the capabilities that you offer as your company matures (more features or servicing more customers' coverage with a growing team of support or customer success managers) or a function of credibility. If you have a hundred clients now with logos on your website versus five, you've reduced the risk of people doing business with you. That credibility has worth. Each of these - capabilities, coverage, and credibility - has likely increased over time as you run a healthy business.

The last one, catching up, is making the point about inflation. And it's not just inflation, it's also catching up with competitors who have raised their prices in your field.

There might be reasons not to raise your price, but the main concern is if you raise the price too far will the sales volume go down? To find the sweet spot of raising it, you can do a simple survey, such as the Van Westerndorp elasticity test. This is three or four questions you can send to all your customers. There are Survey Monkey templates for it, and it helps you do elasticity testing relatively quickly. However, don't go overboard in all kinds of analysis. Do not assume that a specific price point cannot be borne by the market unless you actually test it in the real world, because you'll do a lot of analysis without gaining many real insights.

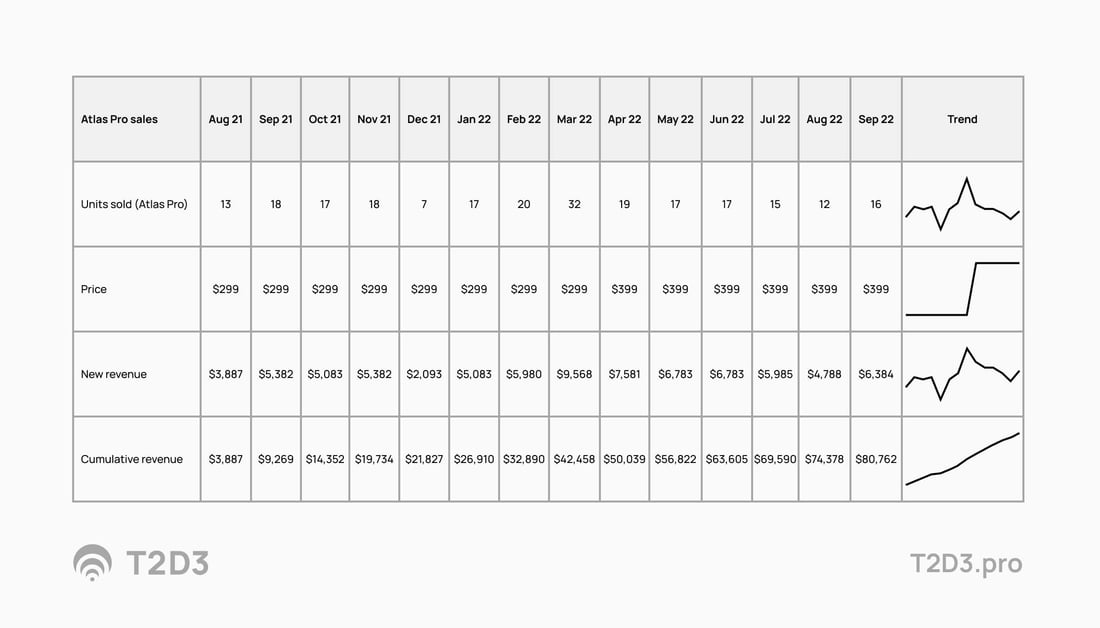

We sell a website template for B2B SaaS companies. It was listed at $299, and then we raised it to$399. Nothing happened. The spike of 32 that you see under March 2022 was related to a campaign that drove some extra sales. If you just look at the units sold on the top line, it didn't change. Of course, this is a relatively small volume, so statistical accuracy here might be limited. But the reality is that we raised the price by 33% and increased the revenue by 33%. So a no brainer.

Large, billion-dollar companies, are raising prices left and right - and they may handle breaking the news to customers differently than a smaller SaaS company. For instance, Microsoft Office 365 - one of the biggest and most successful - recently sent out an email stating that prices were going up by 20%. There was no new value to the services, at least not that I'm aware of. They mentioned that they’re “always innovating,” but they don’t feel the need to list the thousands of things that may have been added to Office 365 in the last year. They have an easy sort of business model here because who's going to be able to decline? You still need your Microsoft toolset tomorrow. Not much you can do if they raise the price.

But this is not unique. You probably all have had emails like this in the last couple of months from vendors like HubSpot, Dropbox, Slack, etc. So don't be shy. Microsoft is doing this with a billion-dollar business that they're cautious about, and they don't blink at a fairly significant increase.

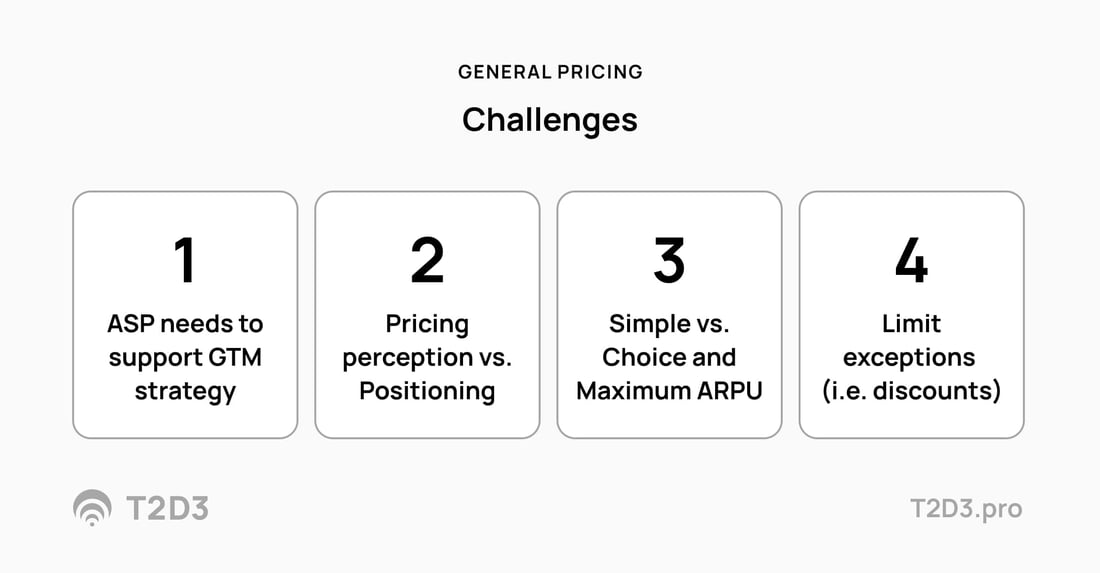

There are four main challenges associated with pricing strategy.

If you have a relatively low price point, it's harder to afford hiring people to sell your product proactively, having sales conversations, etc. So those things have to be in tune with your plan. How does the price level align with the thesis that you have to grow your business? If you have all kinds of fancy ideas for building, and investing in sales and marketing, does the price level support those investments?

Pricing is also connected to how you are seen or perceived in the market. Are you seen as the premium player? Or, are you seen as the value player? That's a critical consideration - one in which you might not raise your price.

The last two challenges are more about the mechanics of pricing. You want to balance simplicity with allowing yourself and your sales team to maximize the revenue per unit or user. They need the flexibility to get as much compensation for your value prop as possible. And sometimes those two are at odds with each other. Simplifying your pricing might make it harder for sales to optimize the number of dollars they can get. And then the other part is choice. You want your customers and your prospects to feel they have some control over what pricing plan they choose.

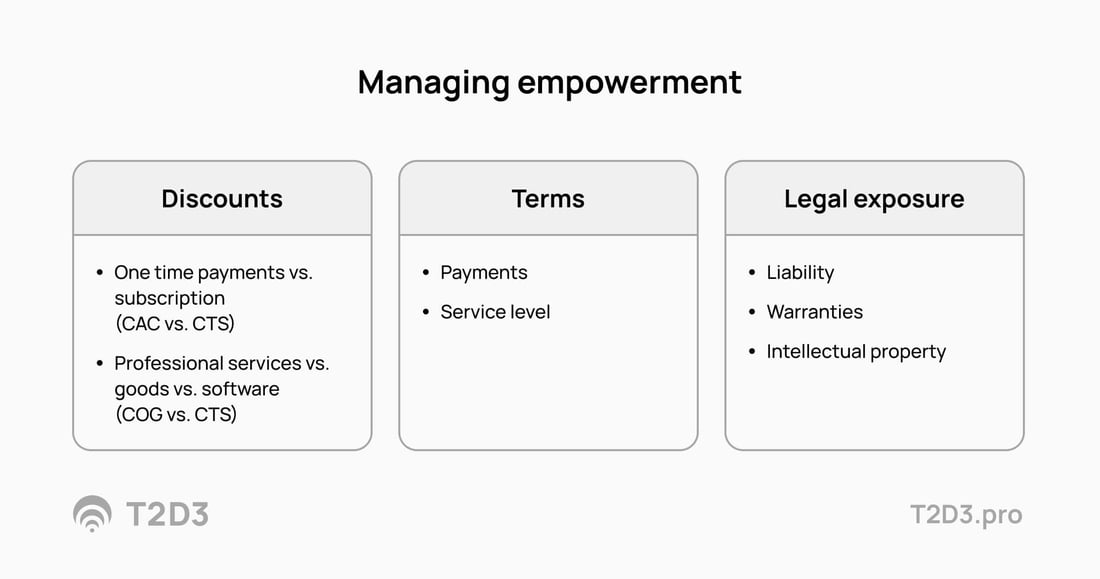

The last common problem is when pricing becomes too high, which may introduce all kinds of discount behavior that was not intended. That creates extra friction because now you need to manage discounting empowerment to allow sales to win, while also maintaining an optimally high price point.

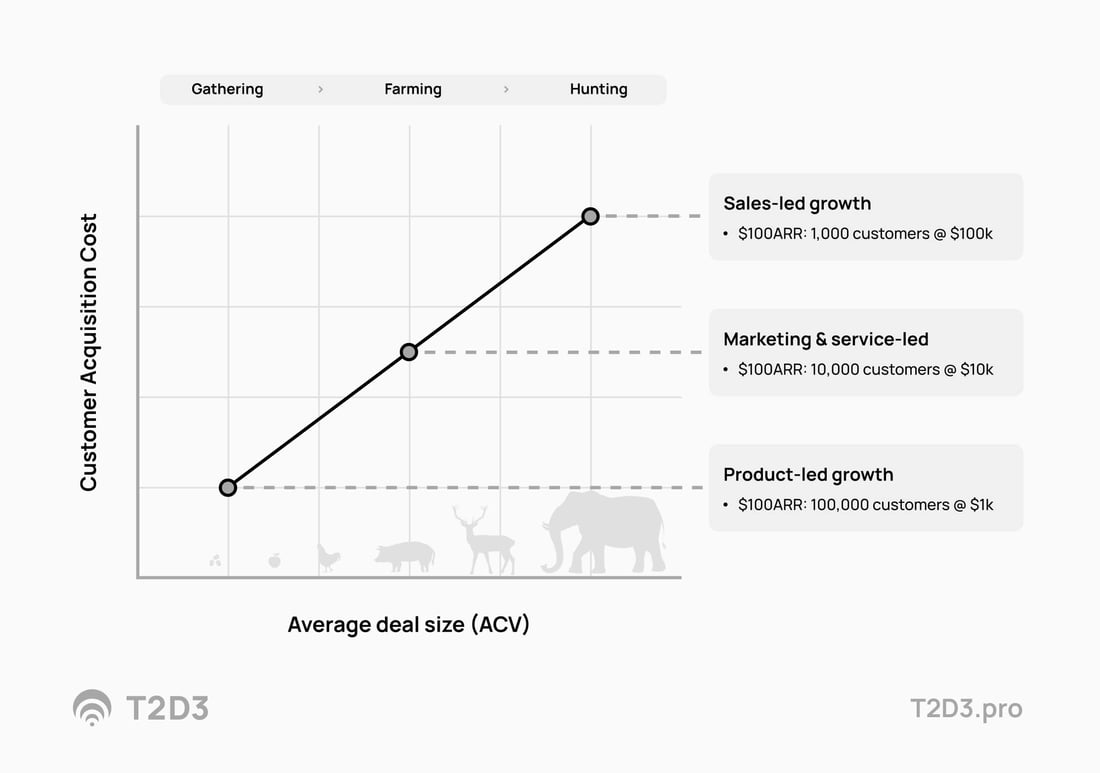

Particularly for early-stage founders, but it's just as true for later-stage CEOs; when you have a growth thesis, and you say, "Hey, I'm going to pour a certain amount of my growth capital into a go-to-market investment, investing in marketing, investing in sales, investing in expanding my customer success team." First, you must ensure that that investment thesis aligns with the price point, the ASP, the average selling point price, or the contract value.

You can put any term on the horizontal axis there or ARPU. Still, it aligns with your customer acquisition cost on the vertical axis that allows you to, if you want to do marketing and service-led, grow to invest in buying Google Clicks, having customer success teams or support, or in an actual executive sales force.

Sales reps are expensive. You cannot afford that if your average sales price or contract value doesn't support that investment.

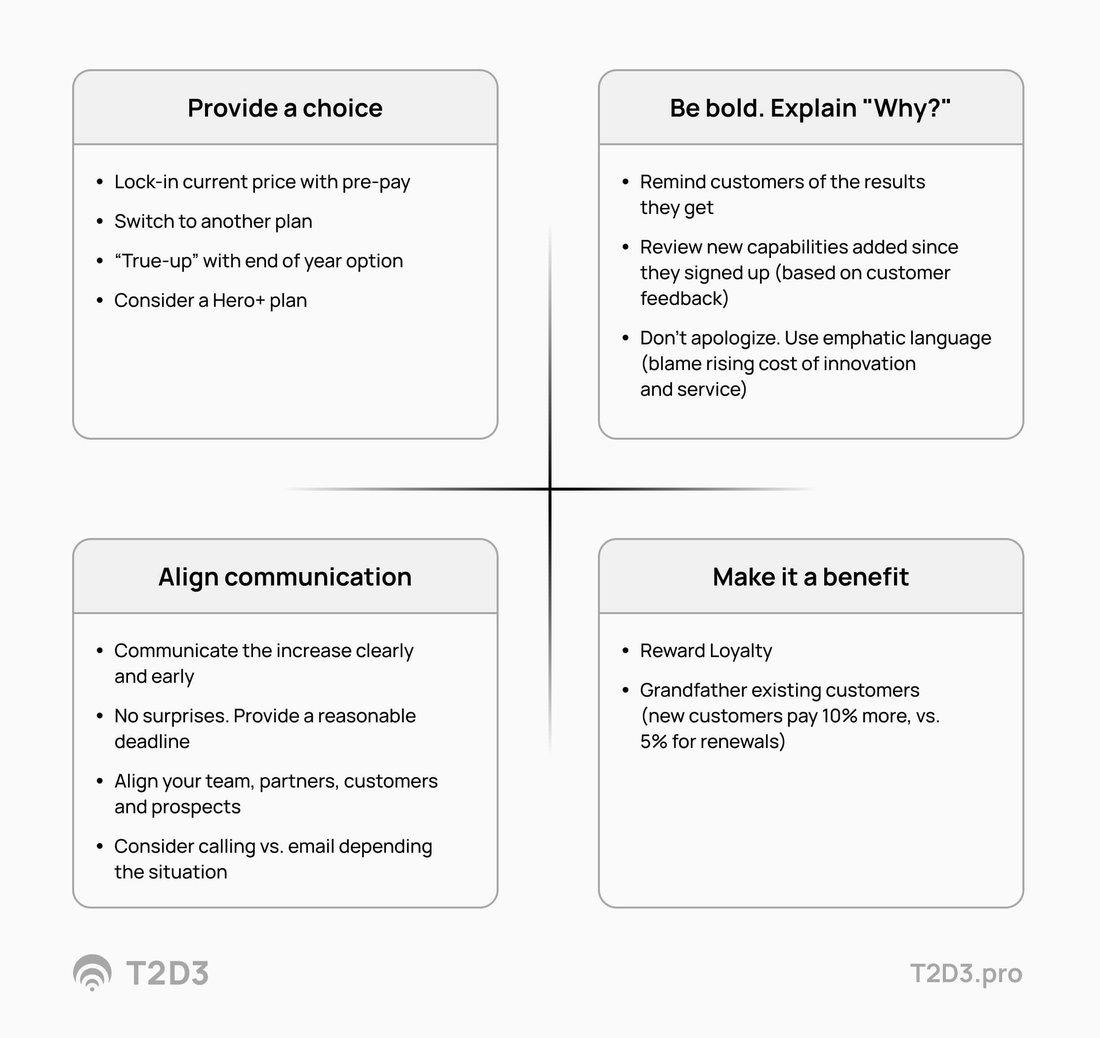

So when it comes time to raise the price - which I recommend doing if you haven’t done so in the past six months - how do you do so strategically? How do you make it appear as more of a benefit? For existing customers, can you provide them something of value that makes the price increase not just a negative experience?

One method is to reward current customer loyalty. You can give them special treatment in which everybody else has to pay more, but because they’ve been with you, there is a chance to lock in a lower price or perhaps a prepaid bundle that isn’t available to new customers. Another option is to allow them to switch to another plan, or even downgrade if it fits their needs better.

When setting the new price level, there are ways for you to introduce the price increase but not immediately let that turn into an invoice. For example, Microsoft always used this notion of “true up” with enterprise agreements. It’s still part of many companies who have annual commitments where they say, "Hey, for the year that you commit, you're not going to pay more”.

If your price is, for example, per user, and your customers add users over the year without any friction, at some point you can send an email or give a call and say, "Hey, you added so many users now your price will go up per January 1st." Then customers can still opt out and say, "Hey, please deactivate all these users." That will be far less friction or churn than paying the new price point.

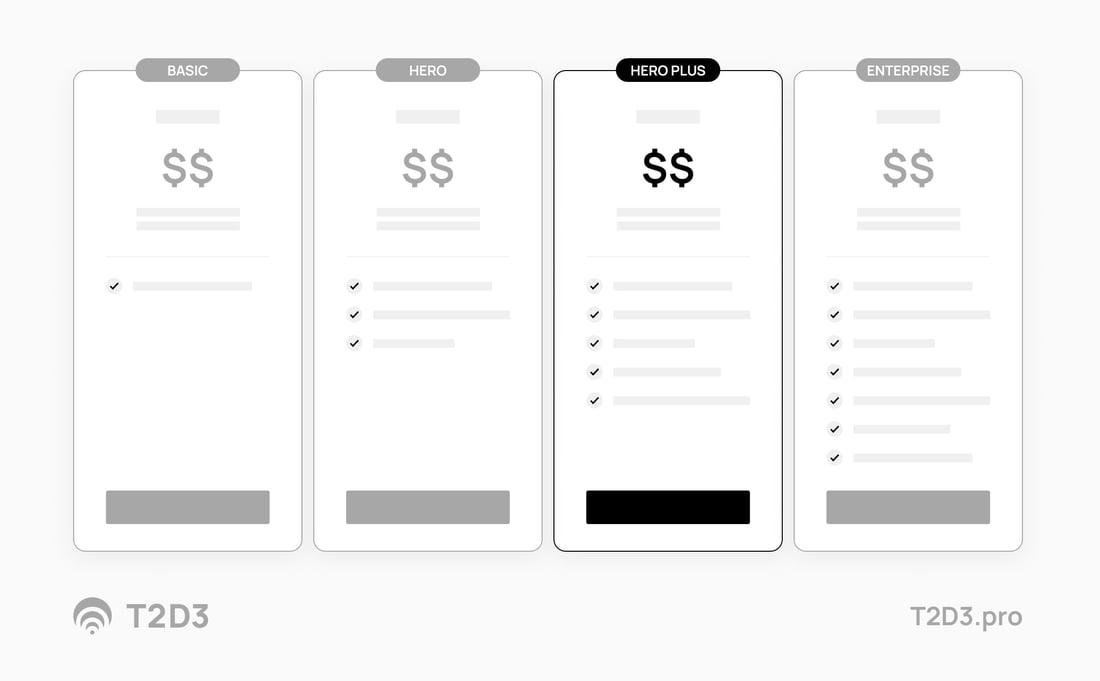

So those are just some examples of ways to provide customers with a certain sense of control and a certain sense of agency. Another way is the ‘Hero Plus’ plan.

This plan gives a decoy, a hero, and an anchor - three price levels. Whether you get some gas at the Shell station or buy a SaaS product - this is a highly effective pricing strategy. What I've seen happen a lot, and had a lot of success with, is to add in that middle tier next to your hero plan - the pricing package that you want most of your customers to buy - another version called the hero plus. The plus package is not a different product, but it includes a few things that don't cost you a lot or that you might be doing already anyway (24 hours access to support, certain guarantees, some kind of a risk-lowering service).

If you do a lot of handholding for your customers the first couple of months, why don't make that part of your hero plus plan and not give that to the regular customers? Of course, you price that accordingly. You raise the price by 10-20% from the hero plan. I've seen that that is usually very effective and gets many of your customers to actually pick the hero plus plan. They don't want to run any risk, they want to reduce risk. And now they're paying 10, 20% more without them actually feeling that you raised the price. They feel you gave them something new. Something more that they didn't get before, although you might have already been giving them that.

You’ve got to match the level of friction for people to change with what you're willing to ask them to commit. The business of temporary storage is a great example. There's no public storage you can get that gives you a one-year or two-year price guarantee. They're all month to month. Why? Because you're not going to go through the hassle of getting a truck to haul everything out of your temporary storage due to a slight increase. You're just going to pay this constantly repeating price increase. Sometimes they increase the price every two, or three months.

The same concept makes it hard to get out of your ERP or NetSuite subscription once you’ve put all your data in. So multiple businesses, and multiple types of products, will have different levels of friction that tie customers to you. You get commitments. You can use this to show value to your customers. Locking in a price in this high inflationary environment. There's no way this type of inflation increment will go on forever, but people feel so at risk that they're willing to lock in longer commitments because they just don't want to have to worry about it. They pay the most for a problem to go away. So if you include risk reduction, taking away headaches, in your price increase, that’s always valuable to people.

That's one interesting thing about the philosophy of pricing - that people pay money to get something but usually pay more to keep something. You all may have had tickets to a football or baseball game, and you paid a certain amount for the ticket, but when someone offered you more, you weren't willing to sell it for the higher price. Once you have something, you're not inclined to give it up.

Communication. Don't think lightly about this. There's needed communication and training to partners, customers, and to your own team. And don’t forget training...The right timing, the correct sequence, preventing surprises, allowing people to make the choices, and having reasonable deadlines that you can enforce but that is reasonable. It helps to do some analysis by your financial team first to learn which customers will be impacted the most. Maybe some of those will need a red carpet treatment versus just an email.

This process was more challenging a year, two years ago. But right now, in this environment where most people raise prices, is much easier. That's why I say “don’t apologize.”

It’s ok to blame the rising cost of innovation or the cost of service. Because it’s true. You have to pay your team more. Other services you procure have become more expensive. Remind customers of the value that you've provided. All the things you've added, the things you've done in the past couple of years. Make sure customers are aware of specific things you shipped, features, and capabilities you added, or remind them you are investing in things customers requested.

It’s also essential to get everybody on your team aligned on dealing with exceptions when you sell. Exceptions to price, exceptions to terms and conditions, etc.

It doesn't have to be a complex table like the one above, but if you don't have some clarity on who gets to make what exceptions to either price or other terms, that's an opportunity that is kind of like raising the price. You can raise the price, or you can make sure your existing price is managed correctly and that you manage empowerment.

The key takeaway from all of this is that, when raising prices, you need to continually provide value to customers. To the point that you are providing so much value that it’s a “no brainer.” People don’t want to go without. They don’t want the hassle of change. They want to stick around, even if they must pay a little more.

Learn how completing a B2B SaaS pricing strategy and feature matrix can help determine the right pricing for your products and services.

Maximize revenue and scale your company by learning B2B SaaS pricing fundamentals and strategy.

Learn how to conduct and leverage SaaS competitive analysis to support your B2B pricing strategy.