Many business leaders, CMOs, and CROs, are starting their planning for 2023. This usually includes a growth budget for ARR, or bookings growth, and a related budget for the OPEX that will support that growth.

I wanted to share my simplified approach to building a budget, balancing a realistic foundation that a team can believe in, with setting a healthy bar for growth ambition.

Here are my 5 steps to building an annual plan:

Step 1 - Jump-off-Point for your Annual SaaS Marketing Budget.

It’s important to start with a relatively sober foundation of the plan. Base this initial number on the growth factors that you know. Ideally, you have at least a year of historical data that minimizes guessing. This initial baseline should be based on “selling what you have” and not assume any new resources or versions of products that you’ve not sold before.

Here’s a B2B SaaS marketing plan template for SaaS companies.

READ ARTICLE

Good inputs to the plan are:

- New bookings

- $ Bookings won per Sales HC/year

- Average Deal Size

- % Opportunities won

- New opportunities created by Sales

- New opportunities converted from MQLs

- Cost per MQL and marketing budget available

- Quota per seller and number of salespeople who are “making quota.”

- Expansion bookings

- $ Expansion per CS HC/year

- $ Average Expansion Size

- % Of customers that expanded

- New opportunities converted from Marketing Nurture (MQLs)

- New opportunities created by Customer Success

- Quota per CS

- More detailed funnel stages

- % Of SAL becoming opportunities

- % Of SDR meetings becoming SAL

- % Of MQL becoming SDR meetings

- Depending on the scope of the budget, you may want to include assumptions for converting Bookings to Billing/Collections and, ultimately, Revenue Recognition.

While other metrics like % MQLs by Source are interesting to understand marketing efficiency and effectiveness, they don’t really help in creating a budget. If you don’t want to do any of the above, you can also just pick your current bookings and assume the same for next year. That’s your conservative budget baseline.

Step 2 – Creating a realistic SaaS growth plan.

Of course, you expect to grow year-over-year. Your conversion rates should go up based on basic optimization, getting better content, and doing A/B tests. Your funnel should grow as you earn more SEO authority. Your sales and CS teams gain experience that should lead to bigger Average Deal Sizes and higher close rates.

In this step, you should account for these growth factors, with at least modest improvements for each. They will compound into a nice growth ambition for your plan. The factors to account for are typically growing in one or more of three ways: Effectiveness, Efficacy, and Efficiency.

Effectiveness assumptions

Improve doing "the right" things to achieve the goal. For example:

- Applying the 80/20 rule (Pareto effect) to optimize what’s working (the right channels, the right ICP, the right markets).

- Fine-tune when to start marketing and selling new products or features based on improved predictability of R&D outcomes.

- Level up the team by optimizing hiring and development based on what competencies succeed.

Efficacy assumptions

Improve the rate of success in achieving the planned goals. For example:

- Conversion rate optimization by A/B testing of landing pages, content, and emails.

- Deal size growth (sales training, price- and packaging changes, reduce discounts, Efficiency assumptions.

- Increase win rate by increasing funnel speed with automation and improved qualification.

Efficiency assumptions

Improve doing things most economically. For example:

- Monetize and retain existing customers vs. finding new ones to compensate for churn.

- Increase upsell opportunities through nurture, in-product feature discovery, and onboarding.

- Train the sales team to increase capacity to do calls, meetings, and proposals.

Realize that they all add up to a compounding effect, so be very thoughtful about your assumptions for each change.

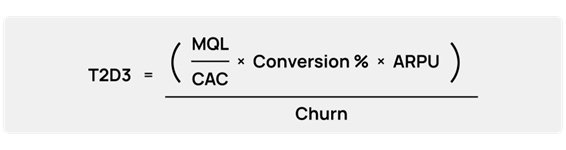

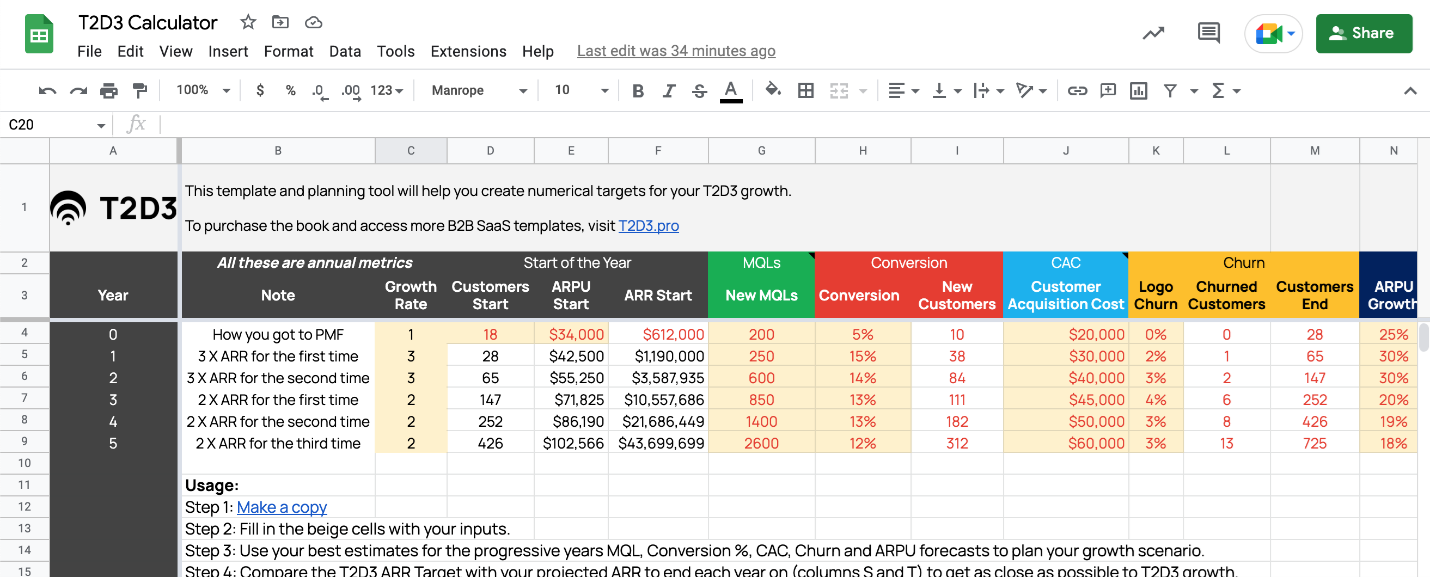

Check out the T2D3 Resources - T2D3 calculator (a 5-year planning worksheet) that allows you to enter all the T2D3 formula factors, MQL growth, Conversion rate optimization, CAC reduction, Churn control, and ARPU expansion, and connect your growth assumptions to specific initiatives that your team will invest in to impart for example MQL growth, or ARPU expansion.

Check out the T2D3 Resources - T2D3 calculator (a 5-year planning worksheet) that allows you to enter all the T2D3 formula factors, MQL growth, Conversion rate optimization, CAC reduction, Churn control, and ARPU expansion, and connect your growth assumptions to specific initiatives that your team will invest in to impart for example MQL growth, or ARPU expansion.

This realistic growth plan is what you can share with your board and the rest of the Executive Team as the plan you intend to realize in the upcoming year. Assuming you can execute what you plan, and the world does not change too much, this is what people can “count on” from you.

Step 3 – Build your “Stretch” budget for your team.

To realize the plan from Step 2, you need to aim a bit higher. From your marketing team having ambitious OKRs to your sales team having sales targets that can support the commissions you plan to pay them, you should add anywhere up to 20% on top of your realistic plan (for some OKRs, it could be even 30%).

For more on OKRs, please check out this article, video, and template.

Building the right incentive plan for your team goes beyond the scope of this article. In general, a stretch target for individual salespeople should be 10% higher vs. the budget from step 2. If you are in a fast-growing market with a high product-market fit, you can set the delta a bit higher, assuming some of your rockstars will know how to get more out of their opportunity. For managers of teams, the stretch should be lower to prevent behavior where a sales manager “holds on” to a low performer because letting someone go would “eat into” their own quota attainment potential too much.

Here are a couple more of my thoughts on compensation for sales, marketing, and CS, and I’ll write more about this in a future article:

- For a growing ARR company with complex roles and multiple people impacting bookings, I have seen OTE (On target earnings) based Bonuses that work better than commissions. Commissions don’t scale in SaaS, while they are a good place to start when you have a couple of salespeople.

- Equity vs. Base vs. Bonus? Here’s my general approach:

- What you do: Base salary

- How effective you do it: Bonus

- What you help build (and increase the value of the company): Equity

- Quota is Plan (from step 2) + Stretch.

- Stretch is smaller by the scope of the role to incent the right manager behavior (hire, develop, retain but also replace as needed)

- Stretch typically ranges from 1% to 10% (higher for IC, lower for larger Span of Control)

- Accelerators support strategy as needed. Ideally, minimize caps to earning potential.

- Have clear quota relief rules/principles. When to PIP based on missing quota?

- Pending the size of the team, keep plans simple while having relevant:

- # Of KPIs

- # Of Accelerators

Step 4: Add New capabilities and additional resources or investments

New product

Steps 1 to 3 were based on “selling what you have.” Now let’s add some assumptions about what your Product team plans to build and how that can impact what you can (up-)sell. This uplift in your budget should be clearly labeled as pending the actual launch of said capabilities, including time to “go to market” with the proper marketing support and prospects going through the typical length of your expected sales cycle.

More resources

If you have access to new growth capital to hire salespeople, invest in brand awareness, or expand to new markets, you should add this to your budget. Just do it as a separate step where you note that your growth assumptions will have less accuracy than the part of your plan that’s based on historical data. For this step, you’ll have to fall back on some benchmarks to plan. Examples are marketing spending a specific % of bookings or the average time you think it takes to hire good salespeople and how long it takes to onboard them and get them to close their first deal (and after that, get to achieving quota).

Step 5: List important Factors outside of your control

While these should not change your plan, I believe it’s helpful to list specific industry trends or market conditions that you believe could substantially impact your planned outcomes or cost. You’ll add to the credibility of your plan by thinking through these, and of course, you can keep an eye on these during the year so your team can react as needed.

Here are some examples:

- Market growth impacting your ICP (by segment, GEO, or Job-to-be-Done).

- Trends impacting your customers (cost of labor, ability to serve certain markets, supply chain)

- Competitive successes or failures are impacting your share of wallet assumptions.

Managing stakeholders

Make sure you understand the expectations of your board, investors, and other stakeholders. As an executive, the most important “capital” you have is your credibility. Inflated growth budgets to warrant excessive spending levels or unrealistic expectations of growth factors outside of your control (market growth or ability to hire talent faster) can’t do much but hurt your credibility long term. Make sure you communicate a realistic plan while also showing the upside that you will, of course, focus on to maximize growth.

Know your customer, i.e., the shareholder. Whether it’s profitability (i.e., EBITDA, Rule of 40%), ARR Growth (T2D3), or ROI (Growth/OPEX, IRR), it’s critical that you understand what your stakeholders expect and what benchmarks they think are applicable to gage your success (let me make sure to thank Mike Dzik at Radian Capital for some of his great insights that helped me perfect and complete this article.)

Don’t spend money you don’t have.

When you raise money and get funded, you are allowed to spend that money based on specific growth expectations. When you want to grow your expenses and need more capital, you must make that specific business case again. Once your board approves your budget, both the Revenue and OPEX sides need to be managed by you. If Revenues start to outpace OPEX, it’s your job to go back to your board and ask if they would like to “bank” this in profits or re-invest in growth. If your OPEX is growing faster vs. your expected revenue, you need to ask your Board if they want you to cut costs and revise your original budget.

Let me know how it goes.

I’m constantly learning from the companies and executives I work with. I’d love you to share your plan with me, including your assumptions, learnings, and insights. I’ll return the favor by providing you with my thoughts and feedback. Just send your notes to stijnhendrikse@t2d3.pro